nh bonus tax calculator

Say for example a single filer. New employers should use 27.

2022 Federal State Payroll Tax Rates For Employers

SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes.

. The assessed value multiplied by the real estate. The state does tax income from interest and dividends at a flat rate of 5 though that rate is slowing being phase. It depends as the IRS uses one of two methods.

This New Hampshire bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. The state income tax rate in New Hampshire is 0 while federal income tax rates range from 10 to 37 depending on your income.

Taxpayers with income from interest and dividends above their total exemption will pay taxes only on the amount that exceeds the exemption. Supports hourly salary income and. Nh Bonus Tax Calculator.

Your average tax rate is 1198 and your marginal tax rate is 22. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value.

Enter your info to see your take home pay. Use ADPs New Hampshire Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Employers typically use either of two methods for calculating federal tax withholding on your bonus. As an employer you also need to pay this tax. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay.

Just enter the wages tax withholdings and other information. The aggregate method or the percentage method. For Social Security tax withhold 62 of each employees taxable wages up until they have earned a total of 147000 for the year.

This marginal tax rate. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. New Hampshire Real Estate Transfer Tax Calculator.

This income tax calculator can help estimate your average.

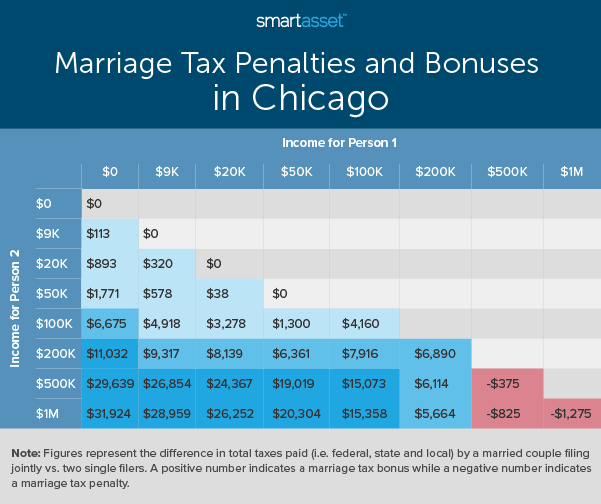

Marriage Tax Penalties And Bonuses In America 2020 Study Smartasset

118 Franklin St Concord Nh 03301 Mls 4903718 Redfin

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Self Employment Tax Calculator Including Deductions

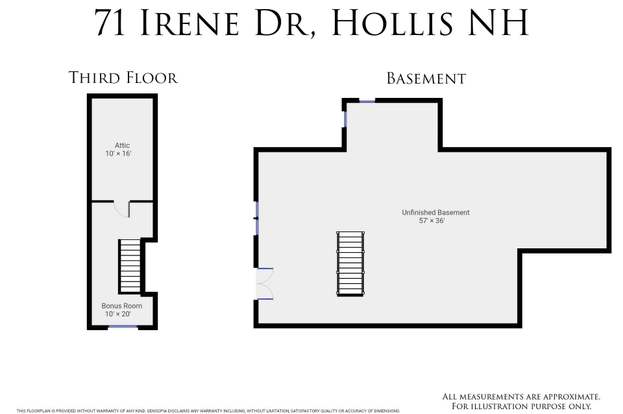

71 Irene Dr Hollis Nh 03049 Mls 4887762 Redfin

Sales Tax Calculator Price Before Tax After Tax More

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

The Complete J1 Student Guide To Tax In The Us

Quarterly Tax Calculator Calculate Estimated Taxes

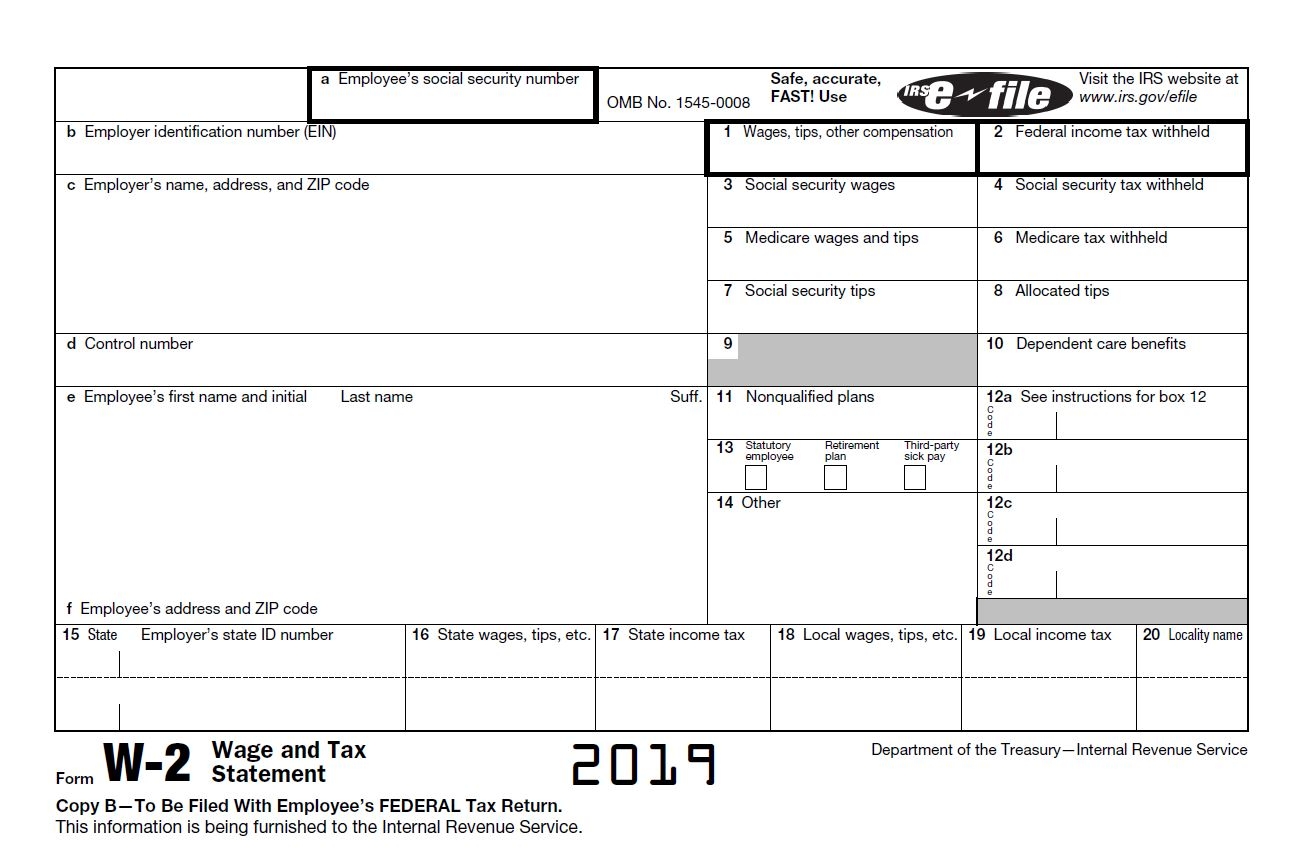

State W 4 Form Detailed Withholding Forms By State Chart

How Are Bonuses Taxed With Bonus Calculator Minafi

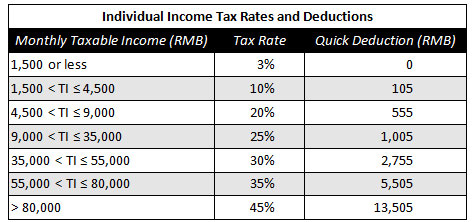

Calculating Individual Income Tax On Annual Bonus In China China Briefing News

Individual Income Tax Colorado General Assembly

Sales Tax Calculator Price Before Tax After Tax More

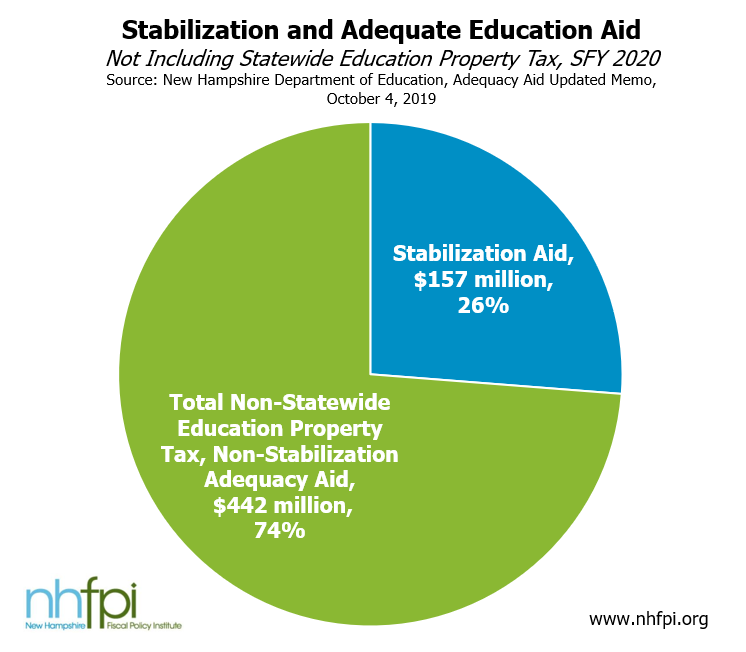

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

How Is Tax Liability Calculated Common Tax Questions Answered

2022 State Tax Reform State Tax Relief Rebate Checks

Taxes On Military Bonuses How And Why Katehorrell

Double Taxation Of Corporate Income In The United States And The Oecd